Will my rent go up in 2023?

Will my rent go up in 2023?

This is a question we are getting a lot from both tenants and landlords as we enter the new year. The news cycle has recently focused on a decline in the home sales market, although that news might be better than it appears on the surface. The housing sales market affects the housing rental market because when people can’t or choose not to buy, they rent.

However, it’s more complex than when one goes up, causing the other to go down. When Lawrence Yun, chief economist for the National Association of Realtors, predicts rent will increase in 2023 by 5%, or Moody’s Analytics predicts rent will increase by 5%-7%, that doesn’t mean your rent will increase by 5-7%.

The home’s locality and size have as much to do with rental prices as the national housing situation.

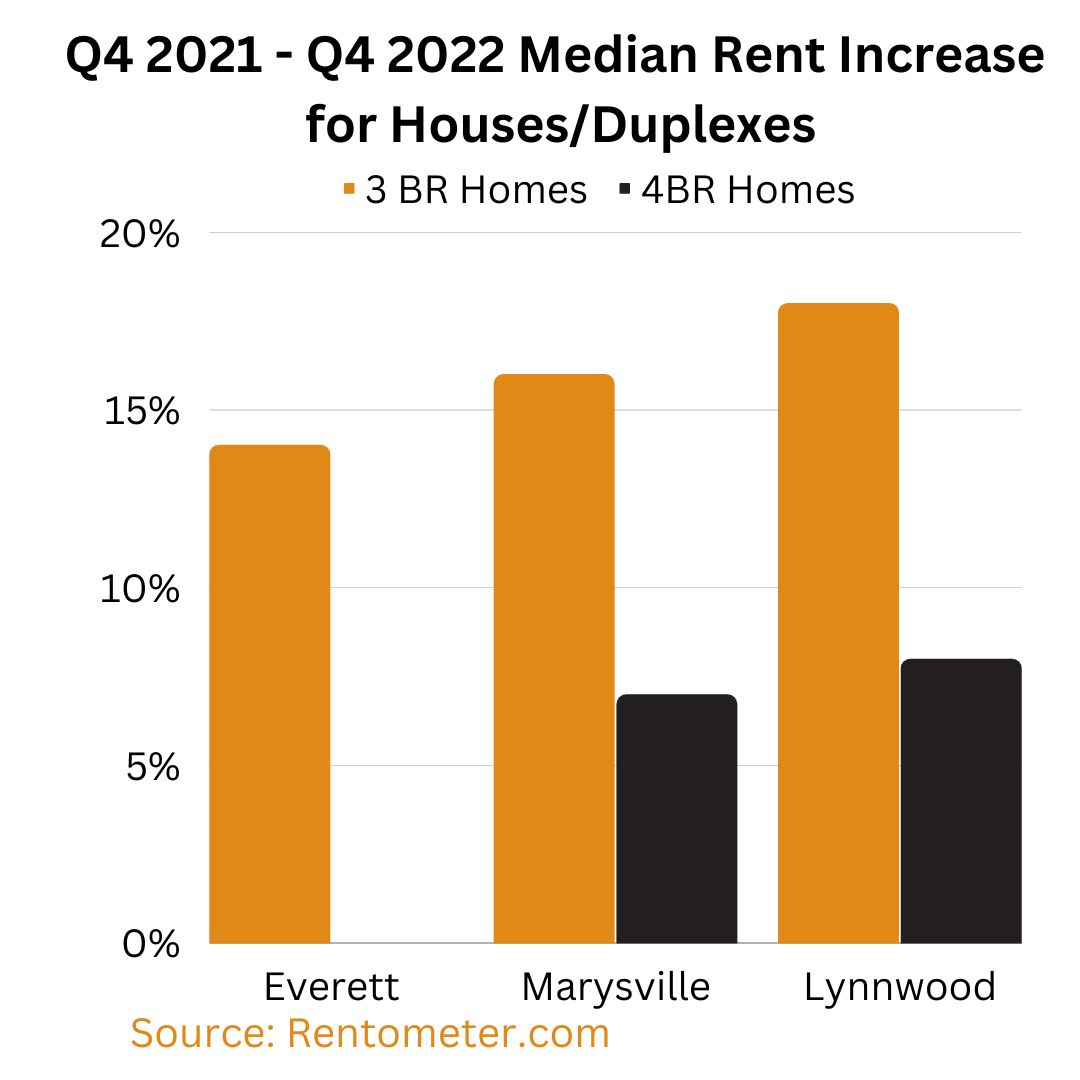

For example, let’s compare three-bedroom rental houses or duplexes to four-bedroom rental houses or duplexes in Snohomish County. In Marysville, the median cost to rent a four-bedroom home in Q4 of 2022 ($2995) was the same as in Q4 of 2021. On the other hand, three-bedroom homes increased by 14% from Q4 2021 to Q4 2022. Everett and Lynnwood also experienced a similar effect. Everett’s four-bedroom homes increased by 7% during the same period, while three-bedroom homes increased by 16%. Lynnwood’s increases were 8% and 18%, respectively.

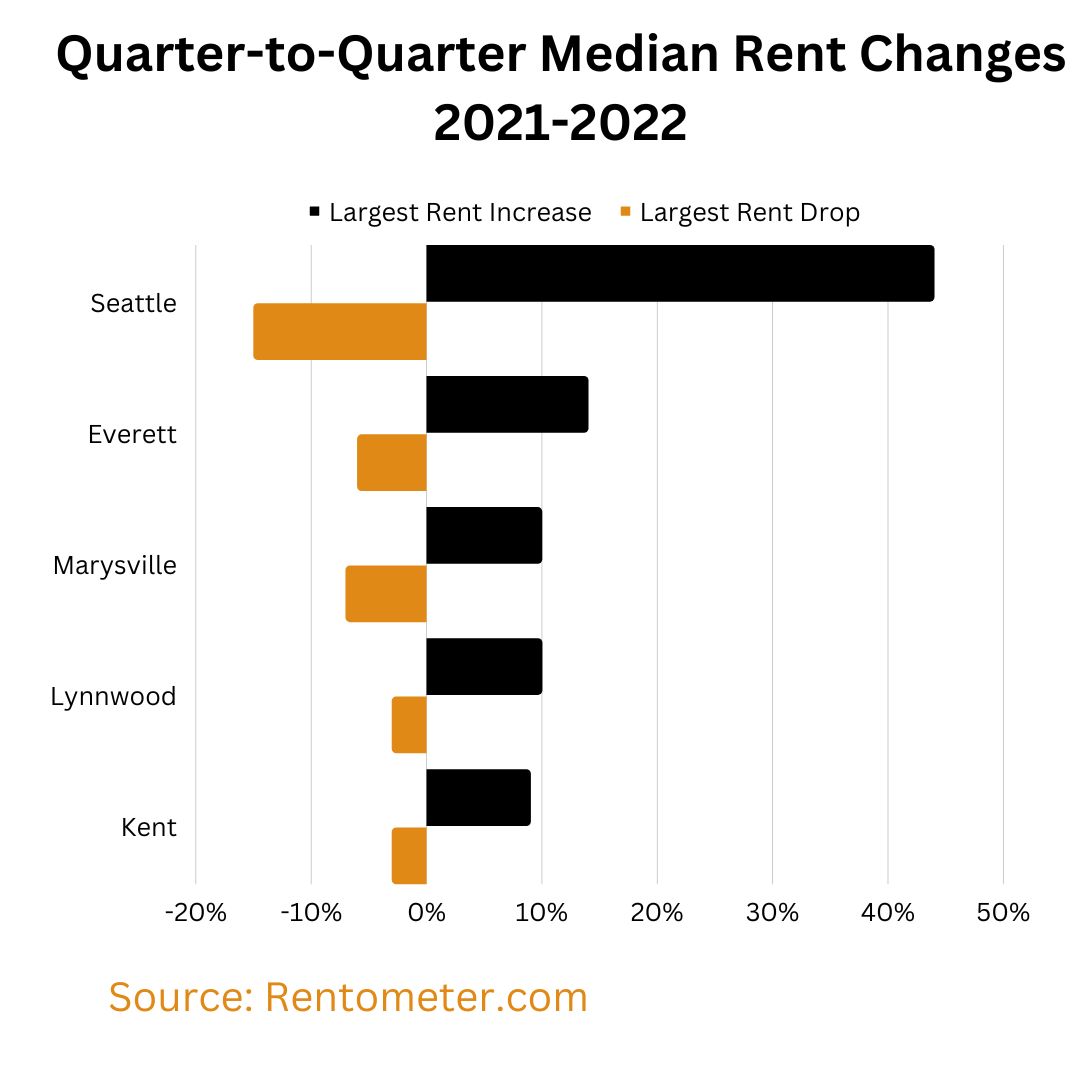

Rental prices in the biggest cities showed much more volatility over the past two years than in their neighboring communities.

In King County, Seattle experienced much more volatility than nearby communities. It had over the last two years, quarter-to-quarter rent decreases in four-bedroom homes as significant as -15% (Q4 ’21- Q1 ’22) and rent increases in four-bedroom homes as high as 44% (Q1 ’22 – Q2 ’22). Kent, in comparison, only experienced -3% (Q3 ’22 – Q4 ’22) as its most significant quarter-to-quarter rent drop in four-bedroom homes and 9% (Q3 ’21 – Q4 ’21) as the largest increase.

In Snohomish County, Everett, the largest city, experienced a maximum quarter-to-quarter price increase of 14% and a maximum quarter-to-quarter decrease of -6%. Nearby Lynnwood, in comparison, had a maximum increase and decrease of 10% and -3%, respectively.

What does this mean for your rental price?

You can’t just follow the national news when evaluating whether your rent is at market rate. It is essential to understand local economic factors, such as housing supply and employment forecast, and determine if your rent is realistic because these factors can significantly impact the demand for rental properties in your area. If there is a high demand for rental properties, landlords may be able to charge higher rents due to the competition for available units. On the other hand, landlords may need to lower their prices to attract tenants if there is a low demand for rental properties. Understanding local economic factors can also help you negotiate a fair price for your rent, as you will better understand what is considered reasonable in your area.